Bad Credit Loans

Need financial help but got a bad credit score? Bad credit loans are your lifeline. Bad credit loans online are readily available and offer numerous benefits, including a simple and speedy application process. We’ll show you how to get funds without getting stuck with bad terms. Learn to borrow responsibly and navigate your options with ease.

How to Choose Your Bad Credit Loan

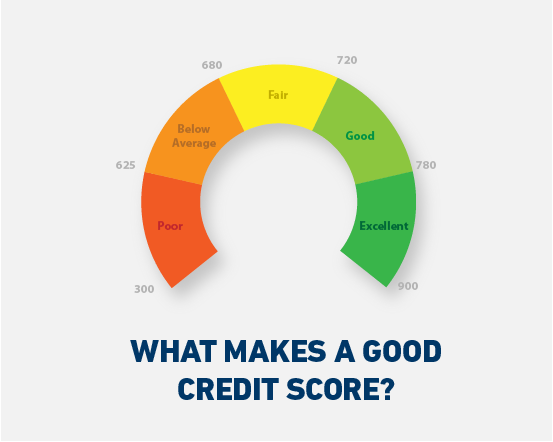

When looking for bad credit loans, you need to know your credit score and borrowing power first. First and foremost, create a repayment plan within your means to avoid financial stress.

The road to getting your loan approved is longer if you show fiscal responsibility. It’s easier to convince lenders if you show savings or consistent repayments and proof of improvement in your finances. Most importantly, take care of your credit rating—that’s tied to your overall credit score—with on time payments and good debt management to get better lending terms, lower costs when borrowing and higher approval chances. Credit checks are key here. They give lenders a peek into borrowers’ past financial transactions.

To get bad credit loans approved, it is crucial to demonstrate fiscal responsibility and improvement in your financial situation. Lenders are more likely to approve loans if you can show savings, consistent repayments, and a stable income, even if you have a poor credit history.

To start this journey successfully make sure you meet these basic requirements.

- 18 years old and above

- Australian citizen or permanent resident

- No current bankruptcy

- Proof of income and outgoing expenses available

Remember to have this knowledge with you during this process it’s not just about loan approval. It’s about charting a path to better financial health and stability.

Repairing Credit While Borrowing

A bad credit score doesn’t have to be a permanent scar. It’s just an obstacle that can be overcome. A bad credit personal loan can be used for various purposes such as home furnishings, debt consolidation, medical bills, holidays, and urgent car repairs, and is accessible even for individuals with poor credit history. A bad credit loan when managed well and responsibly is a powerful tool to fix your credit reputation. Make on time payments. Each on time payment is like polishing your credit report, building an image of reliability and trustworthiness even for those with poor or bad credit history.

Late payments won’t disappear into thin air but responsible financial habits will gradually dim their effects. Each on time payment you make adds to a harmony of good money management that resonates positively to lenders—a melody that leads to better borrowing terms and more financial options in the future.

Remember taking a loan is not just about getting funds now—it’s about setting yourself up for long term financial success. Bad credit loans and cash loans are like building blocks while your commitment to repayment is the mortar that holds them together to pave the way to financial stability.

Avoiding Debt Traps with Bad Credit Loans

The urgency of financial help can mask the hidden dangers of bad credit loans for the unsuspecting. Bad credit car loans, in particular, come with specific risks such as higher interest rates and the potential for repossession if payments are missed. High interest rates and fees that are common for such loans can trap you in a debt cycle that’s hard to get out of. To protect yourself make sure to scrutinize any online bad credit loans offers to check if they are fair and if excessive charges are being hidden in fine print.

Although credit cards or payday loans may seem appealing at first, they can lead to a debt spiral if not managed and disciplined. It’s not just about reading but understanding how borrowing will affect you in the long run. Choosing a loan that fits your budget and repayment capacity is key to not getting into financial trouble.

Instead of leading you to more trouble, getting a loan with bad credit should ideally be used as stepping stones to financial recovery. Think carefully on this journey to solvency—be strategic on what steps to take first based on planning and caution.

Remember the terrain is rough but the path to financial solace is walkable with the right knowledge and mindset. From fast approvals to financial education the options are many, each with its pros and cons. Your journey doesn’t end with loan approval; it’s a continuous journey of financial wisdom and growth. May this guide be your map to a financially secure future, lit by informed decisions and commitment to your financial well being.