When it comes to managing your finances, one critical aspect to keep in mind is your credit score. A good credit score can open doors to loans, better interest rates, and even job opportunities. On the other hand, a bad credit score can limit your options and have long-lasting consequences. This article will explore the definition of a bad credit score in Australia, its consequences, and how to improve it.

Understanding Credit Scores

A credit score is a numerical representation of your creditworthiness based on your financial history. Lenders and other financial institutions use this score to determine the likelihood of you repaying your debts.

How Credit Scores Are Calculated

Credit reporting agencies in Australia use a variety of factors to calculate your credit score. These factors include:

Factors Affecting Credit Scores

- Payment history

- Credit utilisation

- Length of credit history

- Types of credit accounts

- Recent credit inquiries

Bad Credit Score Range in Australia

A bad credit score in Australia typically falls within the range of 0 to 559, according to the Experian credit score scale. This score indicates a higher risk of defaulting on loans or credit card payments.

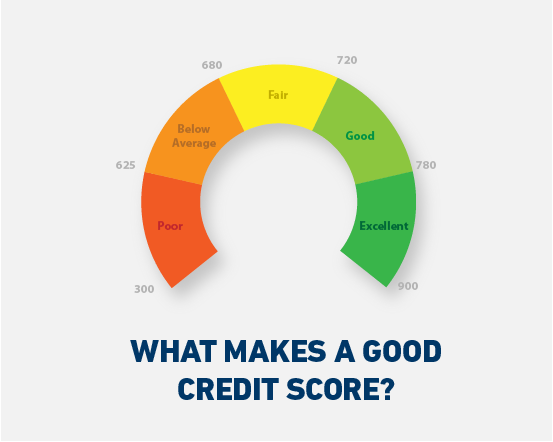

The Credit Score Scale

Australian credit reporting agencies use different scales. Here are some common credit score scales used by the major credit bureaus in Australia:

Credit Score Categories:

- Experian: 0-1,000

- Equifax: 0-1,200

- Illion: 0-1,000

Each credit bureau has its own categories for credit scores. For example, Experian categorises credit scores as follows:

- Excellent: 800-1,000

- Very Good: 700-799

- Good: 625-699

- Fair: 550-624

- Poor: 0-549

Consequences of a Bad Credit Score

Having a bad credit score can have several negative impacts on your financial life. Some of the consequences include:

Difficulty Obtaining Loans

Lenders may be reluctant to approve loan applications from individuals with bad credit scores. If approved, they may offer smaller loan amounts or shorter repayment terms.

Higher Interest Rates

Borrowers with bad credit scores are often charged higher interest rates, as they are considered riskier investments for lenders. This can lead to higher overall loan costs.

Employment and Insurance Implications

Some employers and insurance companies may use credit scores as part of their decision-making process. A bad credit score can hinder your job prospects or result in higher insurance premiums.

Improving Your Credit Score

If you have a bad credit score, it’s essential to take steps to improve it. Here are some strategies to consider:

Review Your Credit Report

Request a free copy of your credit report from each credit reporting agency. Review it carefully for errors and discrepancies that may negatively impact your credit score.

Dispute Errors

If you find any errors in your credit report, dispute them with the credit reporting agency. This can help improve your credit score by removing incorrect negative information.

Develop Good Financial Habits

Adopting responsible financial habits can have a positive impact on your credit score. Some practices to consider include:

- Paying bills on time

- Reducing credit card balances

- Avoiding excessive credit applications

- Regularly monitoring your credit report

Seek Professional Help

If you’re struggling with debt or managing your finances, consider seeking help from a financial counselor or credit repair service. They can provide guidance and support to help you improve your credit score.

A bad credit score in Australia typically falls within the range of 0 to 559, according to the Experian credit score scale. This can have severe consequences on your financial life, including difficulty obtaining loans, higher interest rates, and potential employment and insurance implications. To improve your credit score, review your credit report, dispute errors, develop good financial habits, and consider seeking professional help if needed.

FAQs

What is considered a good credit score in Australia?

A good credit score in Australia typically falls within the range of 625 to 699 on the Experian scale. Good credit scores are more likely to receive favorable loan terms and lower interest rates.

How long does it take to improve a bad credit score?

The time it takes to improve a bad credit score depends on your individual circumstances and the steps you take to address it. Developing good financial habits and addressing negative information on your credit report can lead to improvements over time.

Can a bad credit score affect my job prospects?

Some employers may consider credit scores during the hiring process, particularly for positions that involve handling money or sensitive financial information. A bad credit score could hinder your job prospects in these cases.

How often should I check my credit report?

It’s a good idea to check your credit report at least once a year to ensure it’s accurate and up-to-date. You can request a free copy of your credit report from each credit reporting agency annually.

Can I still get a loan with a bad credit score?

While it may be more challenging to obtain a loan with a bad credit score, it is not impossible. Some lenders specialise in providing loans to individuals with poor credit. However, these loans may come with higher interest rates and less favorable terms.

LendExpress.com.au does not list all the lenders in the market. The lenders listed in this article are not representative of all the lenders available in the market. There may be other loan providers available that are not listed here. LendExpress.com.au may have a commercial arrangement with lenders featured on this site.

LendExpress.com.au believes all information to be accurate on the date published. This information is general and does not take into account your specific personal situation. For advice, seek a professional advisor. For debt problems and free advice about debts, contact the National Debt Helpline on 1800 007 007.