Tips

Your credit score plays a big role in the interest rate you’ll get on a car loan. A higher score means a lower rate, and that can save you a lot of money over the life of your loan. But if your credit is less than stellar, don’t worry – there are steps you can …

When your credit score is in the dumps, it can feel like your financing options are limited. Banks and traditional lenders often give you the side-eye when your credit history is less than stellar. But don’t throw in the towel just yet – there are alternative financing routes you can explore that cater specifically to …

Seeking a bad credit boat loan in Australia can be a challenge, but it’s far from impossible. Many Australians with less-than-perfect credit histories are still able to finance their dreams of boat ownership. This guide delves into where and how to find boat loans tailored for individuals with bad credit, highlighting the process, considerations, and …

Getting a car loan can feel like a steep hill to climb, especially if you’re on Centrelink and your credit score isn’t exactly brag-worthy. It might seem like the finance world is giving you the cold shoulder, setting the bar too high for folks just trying to make ends meet. But don’t throw in the …

Energy efficiency is one of the top factors that add to economic stability and sustainability. Less energy consumption for daily tasks means big cuts in energy costs. They all add up to hundreds of dollars in savings per year. Today we look into some best practices to save on costs from using your utilities. Many …

The holiday season means many gifts, food, parties, and other festive expenses. Many Australians will have bigger shopping bills this time of the year. But that doesn’t mean they can’t save on these Yuletide expenses. There’s Cashrewards, a cashback web app that can cut back on some of the big spending and get your budgets …

Managing debt can feel like a juggling act, particularly when it’s hindering your ability to save. It’s a common dilemma: should you focus on saving money or concentrate on paying off your debt? The good news is, it’s possible to handle both debt and savings effectively. Start with an Emergency Fund When planning to pay …

Hey there! Today, let’s chat about something we all face at times – the need for some extra dough. Whether it’s for an out-of-the-blue car fix, a shiny new fridge, or just to keep things rolling, loans can be a real game-changer. But hey, it’s not all about just grabbing the cash; it’s about knowing …

We Aussies treasure our coffee; it’s pretty much a cultural icon down here. But have you ever wondered just how much that daily hit for your taste buds is gonna cost you as you roam across the country? Let’s spill the beans on the average price of a cup in various Aussie spots, from the …

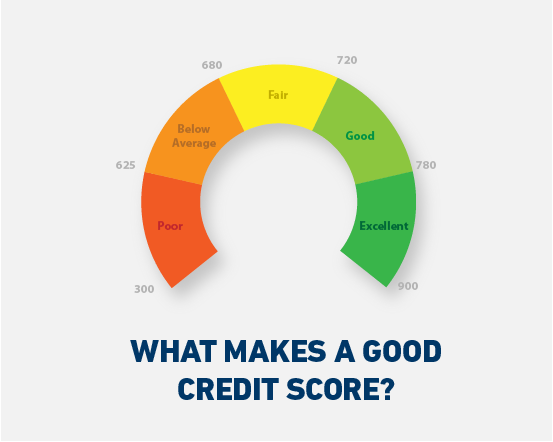

In the realm of financial stability and planning, understanding credit scores becomes an essential undertaking. This comprehensive guide focuses on the credit score dynamics in Australia, presenting an in-depth understanding of normal, bad, and minimum acceptable credit scores. We will also explore methods to fix bad credit scores and boost them quickly. What Constitutes a …

When we talk about ‘bad credit’, we’re referring to a numerical expression that represents the creditworthiness of an individual. This is an assessment based on their financial history, which, when deemed unsatisfactory, can limit future borrowing capabilities. What Constitutes Bad Credit? Usually, credit scores range from 300 to 850, with higher numbers indicating better creditworthiness. …

Inheriting debt in Australia can be a complex and challenging situation. When a person passes away, their outstanding debts do not disappear. Instead, these debts become part of their estate and may need to be settled using the assets they left behind. Understanding Debt Inheritance Laws Australia has specific laws governing debt inheritance. When someone …

Are you wondering if a car loan can help you build credit in Australia? The answer is yes! A car loan can be an effective tool to improve your credit score, provided you handle it responsibly. In this guide, we’ll explore how car loans can impact your credit, tips for managing your car loan, and …

The best payday loans in Australia are available. But first, wise checking and a little research is needed to get to that “best” part. These loans offer the convenience of paying off each instalment on your payday. It makes sure it is paid with no consequences to both the borrower and the loan company. They …

Is it possible for you to get a mortgage after going through bankruptcy? Yes. While bankruptcy is considered a high-risk status among lenders and borrowers, this doesn’t mean you can’t get a loan or mortgage anymore. You just need to search for the right mortgage offers from reputable lenders. You also have to review their …

Are you in need of a car but have bad credit? Getting a traditional car loan may be difficult, but that does not mean you have no options. Rent-to-own car dealerships offer a solution for those with bad credit who need a car. In this article, we will explain how rent-to-own car dealerships work and …

When it comes to managing your finances, one critical aspect to keep in mind is your credit score. A good credit score can open doors to loans, better interest rates, and even job opportunities. On the other hand, a bad credit score can limit your options and have long-lasting consequences. This article will explore the …

Personal Loans can help you cover emergency expenses, personal needs, or major financial undertakings. A personal loan is usually easy to get and needs only a few basic requirements. This makes it an effective form of financing that can resolve funding issues fast. Many banks, financial institutions, and lender parties have all the best intentions …

Australians are not convinced that inflation (and the resulting higher costs of living) will normalise anytime soon. For the majority of them, this is the overwhelming consensus voiced out in a recent Canstar Consumer Pulse Report. Of the 2,157 responders, 44 per cent were worried about the rising inflation and its economic aftereffects. The higher …

Effective on the 1st of January 2023, Centrelink will impose new changes to its benefits payments for many eligible beneficiaries across Australia. These changes will affect younger citizens, people receiving disability and healthcare benefits, caregivers, and local pensioners. There are currently more than 5.5 million plus Centrelink dependents in total. These beneficiaries will receive average …

Brighte is a loan and credit company specifically for use in home improvements, solar installations, heating, cooling, and Green energy needs at home. Their system works just like the well-known companies in the local credit industry, with similar terms and offers. The company has tailor-made its services for these types of projects. Brighte also handpicked …

Many dental credit and financing providers exist to meet urgent dental financing needs. Many of them with higher financing tend to ask for good credit, along with a credit check and other requirements. Some lenders may be more lenient but still uphold a credit check and some supporting details or documents. Don’t fret because bad …

Australians today have many options for borrowing cash for quick financial fixes. While many of our folks are short on debt payments, credit card bills, utilities, household needs, and other major expenses, others may use this loan service to cover their rent. Rent and other immediate expenses are one of the many expenditures Australians had …

Centrelink is the Australian government’s public finance and services program. It was designed to provide financial aid through social security payments to retirees, senior citizens, the unemployed, families, single parents, healthcare employees, disabled citizens, indigenous citizens, and those with financial difficulties, among others. Most recipients of Centrelink assistance are eligible to apply for its advance …

Buy now, pay later loans are popular today for solving short-term money issues. Usually, they are convenient, reliable, and don’t cause too much hassle. Unless, of course, it is not properly orchestrated, the complications of which we will get into later. Finance experts and analysts have observed back in August 2021 that their sudden upswing …

Private money lenders in Australia have become more in demand than ever. With today’s overcrowded loan services market, they may offer better terms such as flexibility, lower fees, and easier repayment options than the bigger, established financial institutions. It all depends on the borrower and what kind of loans they need. Borrowers now have more …

Paperworks for loans are an extra hassle when getting a loan, mortgage, business loan, or if borrowing extra funds. Most banks and financial institutions need them first before accepting. However, you can still get loans without bank statements in Australia. Many other companies offer them certain lending rules that apply in exchange for their convenient …

Our pensioners receive regular payments from their pensions and senior citizen funds. Pensioners looking to loan or borrow funds can use their regular funds for loan repayment. Senior-related loan services enable them to borrow extra money through smaller loans for extra unexpected expenses. Here is a short guide to get the most out of pension …

Loan services have grown alongside Australian e-commerce and finance technology. Today many of Australia’s credit and loan services are in heavy demand online – two main ones being Interest-free finance providers and Digital Lay-by providers. Both have the same services: It is instant purchasing power with a deferred payment plan for instalments. While there are …

The credit and loan industry today has grown to a wider and more competitive level. Even they have to be receptive to their clientele to keep their traction in the free for all loan market: More affordable and convenient services, with low fees, easy repayment, interest-free loans. These features have become common offerings by loan …