In the realm of financial stability and planning, understanding credit scores becomes an essential undertaking. This comprehensive guide focuses on the credit score dynamics in Australia, presenting an in-depth understanding of normal, bad, and minimum acceptable credit scores. We will also explore methods to fix bad credit scores and boost them quickly.

What Constitutes a Normal Credit Score in Australia?

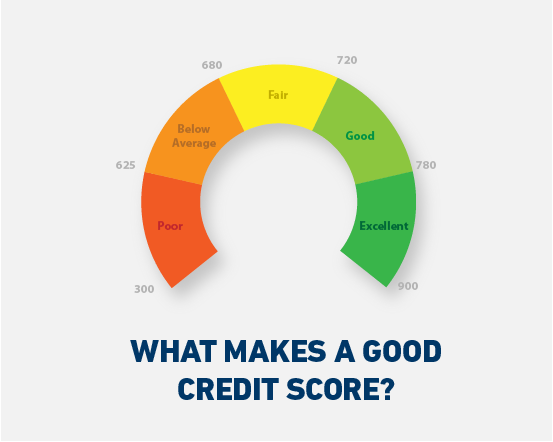

In Australia, credit scores range from 0 to 1200. Typically, a “good” credit score is considered to be 622 or above. Scores in the range of 622 to 725 are considered “good”, 726 to 832 are “very good”, and anything above 833 is “excellent”. Conversely, scores from 509 to 621 are classified as “average”, while anything below 508 is deemed “below average” or “poor”. This grading is essential as it determines an individual’s creditworthiness, influencing their ability to secure loans and credit cards. However, each lender might have a different interpretation of what constitutes a “good” or “bad” score. Consequently, even if you have a good credit score, it does not guarantee loan approval as lenders consider other factors, such as income and expenses. Keep in mind that maintaining a good credit score involves making timely repayments, limiting credit applications, and managing debts effectively.

Interpreting Specific Credit Scores

204 and 550

A credit score is a numerical expression that represents an individual’s creditworthiness. It’s primarily based on a credit report obtained from credit bureaus.

A credit score of 204 is considered extremely low. Typically, scores below 300 are seen as poor, implying that the individual has had severe credit issues, such as multiple defaults or even bankruptcies. This individual may find it difficult to get approved for new credit, and if approved, they’ll likely face high interest rates due to the perceived risk.

On the other hand, a score of 550, although not ideal, is better than 204. It falls into the “fair” category but is still viewed as subprime. Borrowers with this score may still get approved for credit, but they are likely to receive unfavorable terms, such as higher interest rates. It’s advisable for individuals with this score to work towards improving their credit health. Credit scores can be improved by paying bills on time, reducing debt, and not applying for new credit impulsively.

Is a 550 Credit Score Bad in Australia?

Yes, a 550 credit score is considered bad in Australia. Credit scores in Australia range from 0 to 1200, and each score falls into a specific band: Below Average, Average, Good, Very Good, and Excellent. A score of 550 falls into the Below Average category. This can indicate a history of missed payments or defaults, and may make it difficult for you to obtain credit or loans at favorable interest rates. It’s important to remember that different lenders have different criteria, so a ‘bad’ score may not automatically disqualify you from credit, but it could limit your options. If your score is 550, consider seeking advice on improving your credit health. This could include paying bills on time, reducing debt, and not applying for credit frequently. These steps can help improve your score over time.

Recognising a Bad Credit Score

A bad credit score in Australia is typically one that falls below 500 on the scale from 0 to 1200, as used by leading credit reporting bodies like Equifax. This score reflects your financial behavior, including payment history, defaults, and outstanding debts. It’s important to note that each credit reporting body may interpret scores differently. Lower scores indicate higher risk to lenders and can lead to difficulties when applying for loans, credit cards, or mortgages. A bad credit score may result from numerous late payments, bankruptcy, or having defaulted on a loan. Even applying for too much credit in a short period can negatively impact your score. It’s essential to regularly review your credit report for any inaccuracies and to understand your credit behavior to improve and maintain a good credit score. Remember, bad credit doesn’t last forever and can be repaired with disciplined financial practices.

Is 574 a Good Credit Score in Australia?

In Australia, credit scores range from 0 to 1,200. A score of 574 falls into the ‘Average’ category, implying a moderate risk level for lenders. While it is not considered a ‘Bad’ credit score, it may not be sufficient to qualify for all types of credit or the most competitive interest rates. It is advised to take steps to improve this score for better financial opportunities. Regularly checking your credit report for inaccuracies, reducing your debt, and consistently making payments on time can help increase your credit score.

The Threshold: Minimum Acceptable Credit Score

The threshold or minimum acceptable credit score often depends on the context, i.e., the type of loan or credit you’re seeking. However, it’s important to note that a higher credit score will always result in better opportunities and terms.

Generally, a credit score above 670 is considered good by most lenders, indicating a lower risk profile. A score above 740 is viewed as very good, while anything above 800 is exceptional. However, these thresholds are not universal. For example, with FHA home loans, the minimum score can be as low as 580 if you can make a substantial down payment.

In the world of credit cards, the minimum credit score needed for most cards is around 660-670, but cards that offer more rewards or benefits often require a higher score.

Remedying Bad Credit Score

Improving a bad credit score isn’t a quick process, but it’s certainly possible. It starts with understanding your credit report. Obtain a copy from a reputable source and scrutinise it for inaccuracies. If you spot errors, dispute them immediately.

Secondly, consistently pay your bills on time. Timely payment history significantly impacts your credit score. If you have trouble keeping track of due dates, setting up automatic payments or reminders could be helpful.

Thirdly, reduce your credit utilisation ratio, which is the amount of credit you’re using compared to the total available to you. Ideally, you should aim to utilise less than 30% of your available credit.

Lastly, be cautious about opening new credit accounts. While it may increase your total available credit, it could also lower the average age of your accounts, affecting your score negatively.

Bear in mind, rebuilding credit requires time and disciplined financial habits. Avoid quick-fix solutions promising immediate improvement—they usually backfire. Instead, focus on long-term financial management strategies that will gradually build up your creditworthiness. Engaging a credit counselor or financial advisor could be beneficial in setting and maintaining these strategies.

Regular Review of Credit Report

Regularly reviewing your credit report is an essential aspect of maintaining financial health. It provides a comprehensive record of your credit history, which lenders, landlords, and even employers may review to gauge your financial responsibility.

Credit reports can contain mistakes, so it’s crucial to check them periodically to identify and rectify any inaccuracies. Errors such as incorrect payment statuses or fraudulent accounts can lower your credit score, affecting your ability to secure loans or get competitive interest rates.

Moreover, regular review can help you detect signs of identity theft early. Unusual changes, like accounts you didn’t open or sudden increases in debt, could indicate fraudulent activity.

By law, you can access your credit report for free once a year from each of the three major credit reporting agencies—Experian, TransUnion, and Equifax—through AnnualCreditReport.com. More frequent checks might require a fee or a subscription to a credit monitoring service.

To sum up, regular reviews of your credit report not only help keep your financial reputation intact but also allow you to understand and manage your finances

Timely Payment of Bills

Timely payment of bills is a fundamental aspect of managing personal and business finances effectively. This habit demonstrates financial responsibility and is crucial for maintaining a healthy credit score, thus ensuring future financial opportunities remain open and accessible.

When bills are paid promptly, late fees and penalties are avoided. These charges, if frequently incurred, can accumulate over time and add significant, unnecessary costs to your expenses. Moreover, the risk of services being disrupted due to non-payment is eliminated.

By adopting a routine of punctual bill payment, you can also better manage cash flow. Knowing when each bill is due allows for accurate financial planning and budgeting. This helps to avoid any unexpected shortfalls that could impact other financial obligations.

Low Credit Card Balances

Maintaining low credit card balances is a crucial step towards good financial health. It not only aids in easy management of personal finances but also contributes positively to your credit score. High credit utilisation can signal potential risk to lenders and may negatively impact your creditworthiness.

Low balances ensure that you are within the recommended credit utilisation ratio, generally advised to be under 30%. This ratio is a measure of your outstanding balance in relation to your credit limit, and keeping it low is beneficial for your credit score.

Low credit card balances also translate into smaller, more manageable monthly payments, reducing the risk of default or late payments. This helps to avoid hefty interest charges and penalties associated with missed payments.

Diversified Credit Portfolio

A diversified credit portfolio is a financial strategy involving the dispersion of investments across different types of credit products. It includes a wide range of financial instruments such as bonds, credit derivatives, loans, and structured finance products. This strategy reduces risk by limiting exposure to any single asset or risk.

Diversification is a time-tested strategy in the world of finance. It provides a robust safety net against market volatility, protecting investors from the risk of individual credit defaults. When you spread your investments across a range of credit assets, the underperformance of a single asset has a limited impact on the overall portfolio.

Fastest Ways to Boost Your Credit Score

Boosting your credit score doesn’t happen overnight, but some strategies can accelerate the process:

- Prioritise paying off debts: Reducing your debt levels will lower your credit utilisation ratio, which can have a positive effect on your credit score.

- Keep old accounts open: Long-standing accounts with good payment histories can contribute to your credit score positively.

- Limit new credit applications: Too many hard enquiries on your credit report can reduce your credit score.

LendExpress.com.au does not list all the lenders in the market. The lenders listed in this article are not representative of all the lenders available in the market. There may be other loan providers available that are not listed here. LendExpress.com.au may have a commercial arrangement with lenders featured on this site.

LendExpress.com.au believes all information to be accurate on the date published.

This information is general and does not take into account your specific personal situation. For advice, seek a professional advisor. For debt problems and free advice about debts, contact the National Debt Helpline on 1800 007 007.